The richest countries in the world always attract attention, because statistics show where the best conditions for living and working are created. We aim to demonstrate how international economic indicators help determine per capita income levels, and why measures linked to purchasing power parity can be crucial.

At Uniwide, we have prepared and now present a ranking of countries with the strongest economic performance.

Which Indicators Are Used to Determine the Ranking of Rich Countries?

To decide which country is truly the wealthiest, we must rely on criteria that accurately reflect living standards and economic potential.

We pay special attention to several core parameters, since each one clarifies a different aspect of financial wellbeing.

- One key metric is nominal Gross Domestic Product (GDP). It measures the overall value of goods and services produced, based on current prices. However, it does not indicate how the population can actually benefit from that total output. It is important to understand that prices and production costs vary across countries, so a single GDP figure can sometimes distort the scale of real opportunities.

- Another vital metric is total GDP based on Purchasing Power Parity (PPP). It accounts for price levels and real spending on goods and services, offering a more accurate comparison of economic strength. For instance, China, India, and the United States have large total GDP if we account for PPP, yet that does not automatically place their populations in top per capita income positions.

- To evaluate the average earnings of a country’s residents, GDP per capita is also critical. It shows how total GDP is shared among citizens, offering insight into the potential level of each individual’s wealth.

- However, the most precise measure, considering both cost of living and the total population, is GDP per capita at PPP. It shows how much the average person in a given country can afford in real terms.

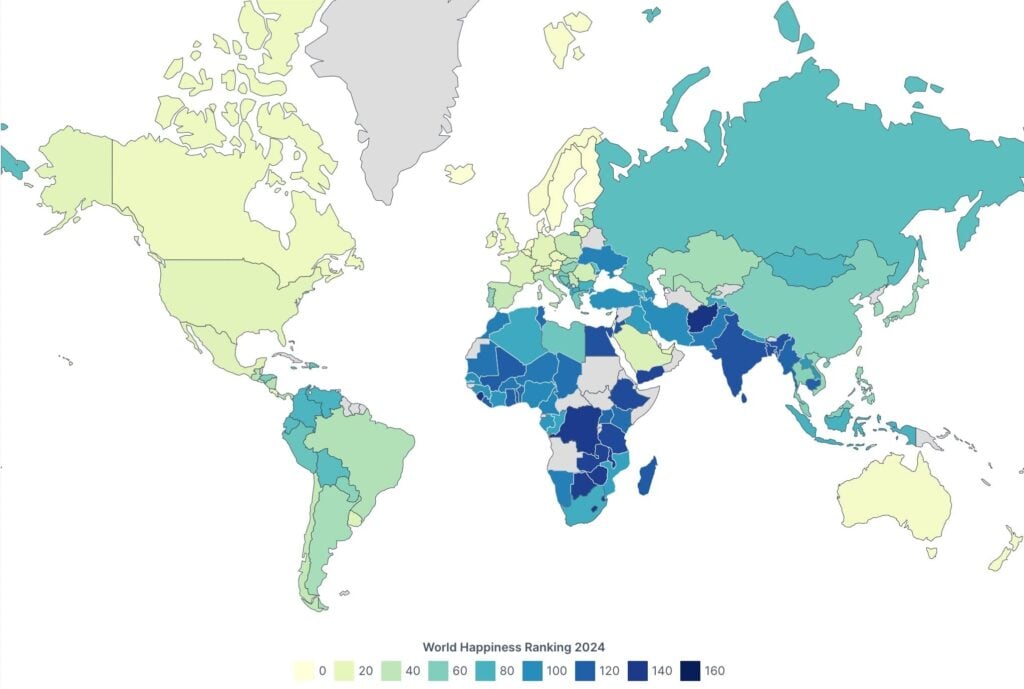

We also assess the World Happiness Index and the Index of Economic Freedom, which broaden our view of life quality and the business climate. Although the happiness index focuses on healthcare and social support, and the economic freedom index reflects prevailing legal and regulatory conditions, GDP per capita at PPP remains the main criterion for identifying which nation provides its citizens with the highest level of financial security.

Ranking of the World’s Richest Countries

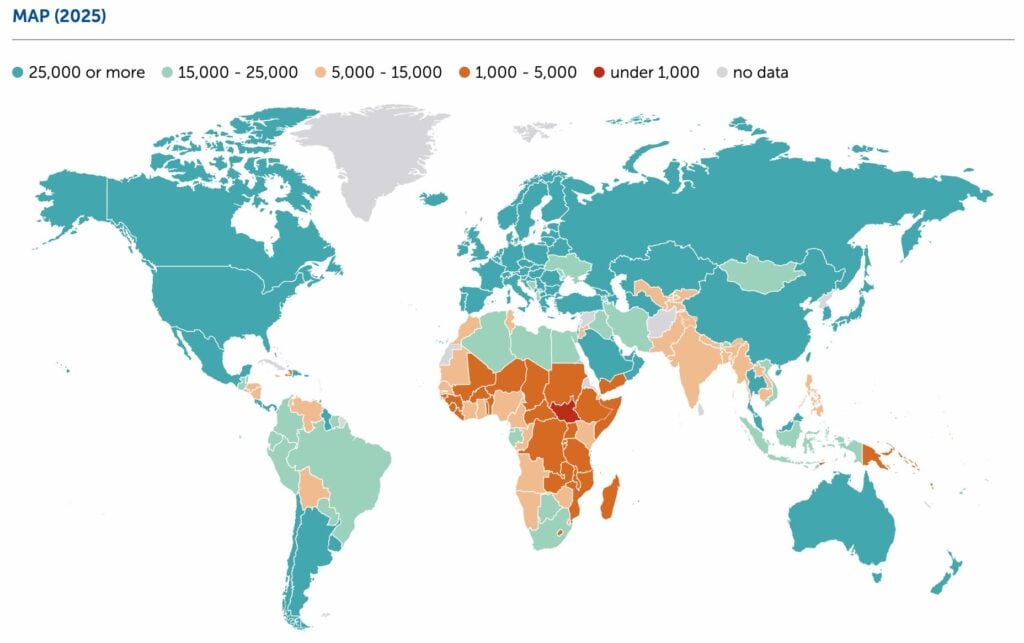

Below we offer a list of nations that demonstrate impressive results in GDP per capita (PPP). The table shows International Monetary Fund data for 2023 (figures for 2024 are not yet final), as well as a forecast for 2025. We also include positions in the Index of Economic Freedom and the World Happiness Index, where relevant data is available. All financial indicators are presented in US dollars.

| Rank | Country | GDP per capita (PPP, 2023) | GDP per capita (PPP, 2025, forecast) | Rank (2025, forecast) | Index of Economic Freedom Position | Happiness Index Position |

|---|---|---|---|---|---|---|

| 1 | Luxembourg | 148693.702 | 154914.923 | 1 (+0) | 7 | 8 |

| 2 | Singapore | 141553.675 | 153608.798 | 2 (+0) | 1 | 25 |

| 3 | Ireland | 126991.820 | 131548.377 | 4 (-1) | 3 | 14 |

| 4 | Macau | 117032.907 | 140245.545 | 3 (+1) | no data | no data |

| 5 | Qatar | 111789.459 | 118761.722 | 5 (+0) | 29 | 29 |

| 6 | Norway | 100153.712 | 106540.416 | 6 (+0) | 11 | 7 |

| 7 | Switzerland | 93054.781 | 98144.794 | 7 (+0) | 2 | 9 |

| 8 | Brunei Darussalam | 86866.545 | 95038.768 | 8 (+0) | 43 | no data |

| 9 | United States | 82715.100 | 89677.894 | 10 (-1) | 21 | 15 |

| 10 | Denmark | 80210.524 | 85788.768 | 11 (-1) | 9 | 2 |

| 11 | Netherlands | 79586.245 | 83822.682 | 12 (-1) | 8 | 6 |

| 12 | Iceland | 78250.289 | 80318.312 | 16 (-4) | 15 | 3 |

| 13 | San Marino | 78121.941 | 82578.756 | 14 (-1) | no data | no data |

| 14 | United Arab Emirates | 74713.617 | 82000.365 | 15 (-1) | 28 | 26 |

| 15 | Taiwan | 74408.882 | 82614.609 | 13 (+2) | 4 | 27 |

| 16 | Austria | 71988.371 | 74975.643 | 20 (-4) | 13 | 11 |

| 17 | Hong Kong | 71627.003 | 78716.519 | 17 (+0) | no data | no data |

| 18 | Belgium | 71035.464 | 75187.071 | 19 (-1) | 32 | 17 |

| 19 | Sweden | 70046.951 | 74143.057 | 21 (-2) | 10 | 4 |

| 20 | Germany | 69531.553 | 72660.471 | 22 (-2) | 19 | 16 |

| 21 | Malta | 69181.837 | 75821.658 | 18 (+3) | 24 | 21 |

| 22 | Australia | 67900.529 | 71308.542 | 23 (-1) | 13 | 12 |

| 23 | Andorra | 67395.980 | 69597.088 | 24 (-1) | no data | no data |

| 24 | France | 63880.888 | 67657.609 | 25 (-1) | 47 | 20 |

| 25 | Finland | 63558.656 | 67073.815 | 26 (-1) | 12 | 1 |

| 26 | Bahrain | 63497.708 | 66966.504 | 27 (-1) | 27 | 42 |

| 27 | Canada | 62266.066 | 64565.675 | 30 (-3) | 14 | 13 |

| 28 | Saudi Arabia | 61932.611 | 65884.713 | 28 (+0) | 39 | 30 |

| 29 | United Kingdom | 60735.429 | 64384.271 | 31 (-2) | 30 | 19 |

| 30 | South Korea | 60046.345 | 65581.597 | 29 (-1) | 17 | 57 |

| 31 | Italy | 59164.515 | 62603.046 | 32 (-1) | 46 | 33 |

| 32 | Cyprus | 56628.363 | 62288.051 | 33 (-1) | 37 | 32 |

| 33 | Czechia | 55206.513 | 59205.196 | 34 (-1) | 26 | 18 |

| 34 | Israel | 53810.401 | 55847.399 | 38 (-4) | 31 | 5 |

| 35 | Slovenia | 53631.545 | 58153.252 | 35 (+0) | 49 | 22 |

| 36 | Guyana | 53584.551 | 91383.498 | 9 (+27) | no data | no data |

| 37 | Spain | 52907.924 | 56659.487 | 36 (+1) | 45 | 35 |

| 38 | New Zealand | 52856.074 | 54038.010 | 42 (-4) | 5 | 10 |

| 39 | Japan | 51399.027 | 54906.862 | 40 (-1) | 23 | 47 |

| 40 | Lithuania | 51129.222 | 55995.397 | 37 (+3) | 18 | 24 |

| 41 | Kuwait | 50933.256 | 51287.073 | 43 (-2) | 69 | 50 |

| 42 | Aruba | 48967.953 | 55054.501 | 39 (+3) | no data | no data |

| 43 | Poland | 48799.413 | 54497.596 | 41 (+2) | 36 | 39 |

| 44 | Puerto Rico | 47717.536 | 50342.863 | 46 (-2) | no data | no data |

| 45 | Portugal | 47226.151 | 51256.666 | 44 (+1) | 38 | 56 |

| 46 | Estonia | 47127.950 | 49696.506 | 48 (-2) | 6 | 31 |

| 47 | Croatia | 46005.225 | 51223.926 | 45 (+2) | 56 | 48 |

| 48 | Romania | 44974.057 | 49943.598 | 47 (+1) | 41 | 44 |

| 49 | Hungary | 44960.952 | 49147.382 | 49 (+0) | 54 | 51 |

| 50 | Russia | 44512.053 | 48956.824 | 50 (+0) | 85 | 70 |

According to current data, Luxembourg holds the top spot as the ‘richest country in the world’ with a 2023 GDP per capita (PPP) of about 148,700 US dollars. Singapore is in second place, clearly outpacing many competitors thanks to its strong financial sector and friendly business environment. Ireland ranks third, actively attracting investors with low tax rates and fostering innovative industries.

Why GDP per Capita at Purchasing Power Parity?

GDP per capita at Purchasing Power Parity (PPP) is considered one of the most reliable statistics for assessing a nation’s wellbeing. It adjusts for currency exchange rates that might distort real income or expenses in a given country. In the end, it shows how many goods and services a typical household can afford.

We see GDP per capita at PPP as a key measure because it factors in both population size and actual living costs. For example, two countries might have the same nominal GDP per capita but very different price levels, which means people in each country would spend that income in different ways.

Another important point is that major organisations like the International Monetary Fund and the World Bank use this indicator to compare living standards. They stress that nominal GDP can be too general and influenced by currency policy subtleties, while GDP per capita at PPP reduces these distortions.

Features of China and India: The Impact of Population Size

Large nations with high overall GDP deserve special attention. China and India are often discussed in the global economy. However, their huge populations reduce GDP per capita. In 2023, China’s GDP per capita (PPP) reached about 20,000 US dollars, and India’s was around 10,000 US dollars. These values are far lower than those of the leading countries.

Significant income inequality persists in these nations. China’s economy ranks second globally in total GDP, reaching about 19.37 trillion US dollars in 2023. India ranks fifth with about 3.73 trillion US dollars. Yet a large portion of their populations lives on relatively low incomes. Even with strong economic growth, per capita wealth remains too modest for these countries to enter the ranks of the world’s richest.

Index of Economic Freedom and Happiness: Other Influential Factors

Beyond purely economic figures, the Index of Economic Freedom and the Happiness Index shape how countries’ wealth is perceived. The Heritage Foundation’s Index of Economic Freedom measures property rights, regulatory efficiency, and open markets. A higher score makes it easier to build businesses and attract foreign investment.

For example, Singapore leads in economic freedom, and Switzerland is close behind in second place. Both countries rank among the richest worldwide, which shows the value of a reliable legal environment.

The Happiness Index includes criteria like life expectancy, social support, and trust in institutions. Finland, Denmark, and Iceland all rank in the top 10 for happiness and also feature high GDP per capita. Although economic power does not always guarantee a top happiness ranking, combining these factors provides a fuller picture of living standards.

Sources: International Monetary Fund, The Heritage Foundation (Index of Economic Freedom 2024), World Happiness Report 2024.

Individual Countries from the Richest Nations Ranking

Below is a brief description of selected countries from the richest nations list. They usually draw strong interest from foreign entrepreneurs.

Rank 1: Luxembourg

Population: about 645 thousand people. Capital: Luxembourg.

General information: This small European nation is known for its stable economy and high living standards. Luxembourg borders Belgium, Germany, and France, offering convenient trade routes. People here value history but also emphasise technology and banking, creating welcoming conditions for global projects.

Taxes for individuals and businesses: Corporate tax stands at about 17 percent. Personal income tax can reach 42 percent on a progressive scale. Tax reliefs and double tax treaties help foreign investors and companies.

Business environment: Luxembourg actively supports financial start-ups and attracts overseas investment. Clear regulations and strong legal protections enable quick company registration and confident growth.

Immigration pathways: EU citizens only need registration. Non-EU specialists can apply for an “EU Blue Card” if they demonstrate high qualifications and suitable salary. Entrepreneurs can gain a permit if they have a business plan that meets local legal requirements.

Rank 2: Singapore

Population: about 5.9 million people. Capital: Singapore.

General information: This city-state in Southeast Asia has earned a reputation as one of the world’s top financial hubs. Singapore combines advanced infrastructure with high technological standards, attracting major global corporations. The city is known for safety and strong support for skilled professionals.

Taxes for individuals and businesses: The corporate tax rate is 17 percent. Personal income tax is progressive and can go up to 22 percent. There is no capital gains or dividend tax, which increases investor returns.

Business environment: Singapore offers fast online business registration and supports innovation through government grants. Strong intellectual property protection and consistent laws make this market appealing to global entrepreneurs.

Immigration pathways: Entrepreneurs can apply for an EntrePass if they have a detailed business plan and sufficient funds. Highly qualified specialists can get an Employment Pass when a local employer offers a position. Over time, they can apply for permanent residence (PR).

Rank 3: Ireland

Population: about 5 million people. Capital: Dublin.

General information: Ireland holds an important place in the European Union and has a fast-growing tech sector. The country is known for its green landscapes, rich cultural heritage, and a welcoming business atmosphere. Many international corporations choose Ireland for their headquarters, valuing the stable economy and skilled workforce.

Taxes for individuals and businesses: Its main corporate tax rate is 12.5 percent, among the lowest in Europe. Personal income tax rates are progressive and can reach 40 percent or more, depending on yearly earnings.

Business environment: Ireland makes company registration simple and provides flexible support programmes for tech projects. Developed infrastructure and open access to EU markets make this nation attractive for foreign entrepreneurs.

Immigration pathways: EU and UK citizens do not require a visa. The “Start-up Entrepreneur Programme” applies to business owners from outside these regions, if they have sufficient funding and a unique idea. Highly skilled professionals can get work permits based on an approved contract.

Rank 7: Switzerland

Population: about 8.7 million people. Capital: Bern.

General information: This Alpine nation is known for its banking sector, high-quality technology, and stable economy. Switzerland is not an EU member, but it has strong trade ties with European countries.

Taxes for individuals and businesses: Corporate tax rates differ by canton, usually ranging from 12 to 22 percent. Personal income tax also varies by region and can exceed 40 percent. A network of double tax treaties reduces international tax burdens.

Business environment: Switzerland is praised for its transparent legislation and reliable infrastructure. It values innovation, especially in finance and biotechnology.

Immigration pathways: EU/EFTA citizens have free registration if they have an employment contract. Third-country applicants face quotas, and obtaining permanent residence requires several years of lawful stay. Naturalisation is possible after a long period of residence, subject to integration requirements.

Rank 9: The United States of America

Population: about 331 million people. Capital: Washington, District of Columbia.

General information: This is the largest economy in the world, covering 50 states with varied climates and legal frameworks. The USA is known for innovative companies, cutting-edge technology, and a huge domestic market.

Taxes for individuals and businesses: The federal corporate tax rate is 21 percent, but states may add extra charges. Personal income taxes are progressive and can reach 37 percent at the federal level, plus local taxes in some states.

Business environment: Entrepreneurs appreciate the developed infrastructure, wide funding options, and transparent legal system. Registering a new company in the USA is quick, especially if digital services are used.

Immigration pathways: H-1B and O-1 work visas suit specialists under contract. Investors choose the EB-5 visa when they provide a significant capital injection. You can enter the “Green Card” lottery and, after five years of residency, apply for citizenship.

Rank 14: United Arab Emirates

Population: about 10 million people. Capital: Abu Dhabi.

General information: This federation of seven emirates occupies part of the Arabian Peninsula. The UAE is famous for modern megacities, high living standards, and cultural diversity. Dubai and Abu Dhabi are global financial hubs, where businesses of all types find growth opportunities.

Taxes for individuals and businesses: There is no personal income tax for individuals in the UAE. The corporate tax rate is 9 percent on profits above AED 375,000. A 5 percent VAT applies to most goods and services. For more information, see “UAE Company Taxes Overview”.

Business environment: Comprehensive legislation, many free zones, and strong infrastructure draw foreign capital. Company registration in the Emirates can take several days to a week. Our experts have created a detailed guide on how to start a business in Dubai.

Immigration pathways: The UAE is one of the most accessible countries for entrepreneurs and professionals who wish to relocate. Entrepreneurs receive a work visa or residence permit through employer sponsorship or by starting a company. Long-term “Golden Visas” are available for major investors, highly skilled professionals, and owners of innovative projects.

Rank 17: Hong Kong

Population: about 7.5 million people. Capital: officially none, but Hong Kong City serves as the administrative centre.

General information: This is a Special Administrative Region of China located on the southern coast. Hong Kong is known for its advanced financial sector, top global banks, and active trade. English and Chinese both play a crucial role in business communication.

Taxes for individuals and businesses: The corporate profits tax rate is typically 16.5 percent (8.25 percent for small businesses; there is a possibility of exempting foreign-sourced income from taxation). Personal incomes are taxed progressively, up to 17 percent. There is no capital gains or dividend tax, which appeals to international investors.

Business environment: An open economy, flexible regulation, and transparent laws promote rapid project expansion. Forming a company in Hong Kong can be done quickly.

Immigration pathways: Foreign entrepreneurs and highly skilled professionals can use the QMAS (Quality Migrant Admission Scheme). For long-term residence, you need to obtain a residence permit. You can gain permanent status after seven years of lawful stay.

Rank 27: Canada

Population: about 38 million people. Capital: Ottawa.

General information: This is the world’s second-largest country by area, known for its natural diversity and bilingual culture (English and French). Canada has advanced technology, agriculture, and a significant mining sector.

Taxes for individuals and businesses: The federal corporate tax rate is 15 percent, with provincial surcharges that can total up to 31 percent. Personal income tax is progressive, with a federal top rate of 33 percent, plus regional add-ons. You can register a company in Canada at the federal or provincial level, allowing flexible business setups.

Business environment: The country features stable laws, access to a large internal market, and good conditions for research and development.

Immigration pathways: The main route is the Express Entry system for skilled professionals. The Start-up Visa Programme is available to entrepreneurs who have support from a Canadian investor. Under certain conditions, you can obtain permanent residency and then citizenship.

Rank 29: United Kingdom

Population: about 67 million people. Capital: London.

General information: The United Kingdom is located on the British Isles and has a rich cultural heritage. It is known for an economy that spans finance, manufacturing, and high-tech. London is considered one of the world’s leading financial centres.

Taxes for individuals and businesses: The corporate tax rate is 25 percent. Personal income tax has a progressive structure, with a top rate of 45 percent for the highest incomes. VAT is 20 percent on most goods and services.

Business environment: The UK has advanced infrastructure and laws that support investors and innovation. Registering a British company is straightforward, including the option to file documents online.

Immigration pathways: Skilled professionals can use the points-based Skilled Worker system. Entrepreneurs may opt for the Innovator or Start-up visa if they provide a suitable business plan and initial funding. Permanent residence is granted after five years of lawful stay, and citizenship follows language and integration requirements.

Rank 32: Cyprus

Population: about 1.2 million people. Capital: Nicosia.

General information: This island nation lies in the eastern Mediterranean. Cyprus features a mild climate, a well-developed tourism sector, and a rich cultural heritage. It is an EU member that actively attracts foreign investment in finance and real estate.

Taxes for individuals and businesses: The corporate tax rate is 12.5 percent. Personal income tax is progressive for residents, potentially reaching 35 percent. Various double tax treaties are in place with many countries.

Business environment: Registering a company in Cyprus is simple, and there is a flexible banking sector with extensive infrastructure for international trade.

Immigration pathways: Permanent residency can be obtained through real estate investment and evidence of stable income. The citizenship-by-investment scheme is temporarily suspended. However, if you meet certain criteria and fulfill the required time living in Cyprus, you can apply for citizenship through naturalisation.

How to Use These Data for Business Development

We recommend closely examining GDP per capita (PPP) and the growth potential of specific markets. If an entrepreneur plans to expand abroad, economic, legal, and social factors in the target country must be considered. For instance, Luxembourg and Singapore offer favourable tax regimes, while Norway and Switzerland maintain high corporate governance standards, giving advantages for new projects.

From a legal perspective, you should study requirements for foreign investors, along with registration and licensing rules for your proposed activities. Many top-ranked countries do not place strict barriers on starting a business, but they do enforce stronger checks on money laundering and compliance with global regulations.

Additionally, comparing raw statistics alone is not enough to launch a project. Each jurisdiction has key laws regulating taxation, banking, and employment. For example, Ireland’s preferential corporate tax rates attract tech companies. In Eastern Europe, some countries offer good terms for manufacturing and exporting, including lower labour costs.

A Practical Example

An international IT firm once considered Singapore and the United States for a regional office. Singapore had high real estate and staffing costs, but the United States might require more time for permits. Analysing purchasing power parity figures and local legal frameworks led them to choose Singapore, thanks to flexible tax schemes and active government support for innovation.

Conclusion

Statistics based on GDP per capita at Purchasing Power Parity (PPP) offer the most accurate idea of which country might be the richest in the world. We highlighted the main factors that influence wealth distribution and showed that a large economy does not necessarily mean high incomes for citizens. For a long-term outlook, a strong ranking position is important, but continuous improvements in people’s quality of life matter as well.

You Might Also Like:

- Establishing a Company in the UAE in 2025

- Emirates ID: A Comprehensive Guide

- Seychelles: corporate and tax legislation reform

- Business Setup Consultants in Dubai: Key to Your Company Formation

- Public Online Registers of Foreign Companies